Be CSDR compliant, improve settlement rates and avoid cash penalty fees.

It is not about managing failed trades – it is knowing when they are ready to settle.

in brief

SureVu is a CSDR solution for settlement discipline management.

Created for investment managers, outsourcers (asset servicing and securities servicing firms) and custodians, SureVu is intuitive, easy-to-use software designed to automate and improve existing settlement infrastructures, bringing scalability in the face of an ever-increasing regulatory environment.

Manage with confidence – mitigate settlement risk that comes with a trail of communications via email, phone or even fax messages. Our exception management hub provides settlement tracking and failed trade management for ALL your security trades.

Control your view of trade positions not those perceived by third parties – SureVu enables users to manage ALL pending trades not just failed ones. By better managing pending trades clients have seen up to a 25% improvement in settlement rates, which is absolutely essential to meet stricter settlement processing times as part of the T+1 settlement date changes.

Avoid unnecessary cash penalties – the added controls of an automated pre-settlement process, with partial settlement management facilities, means the chances of a trade failing in the first instance are greatly reduced.

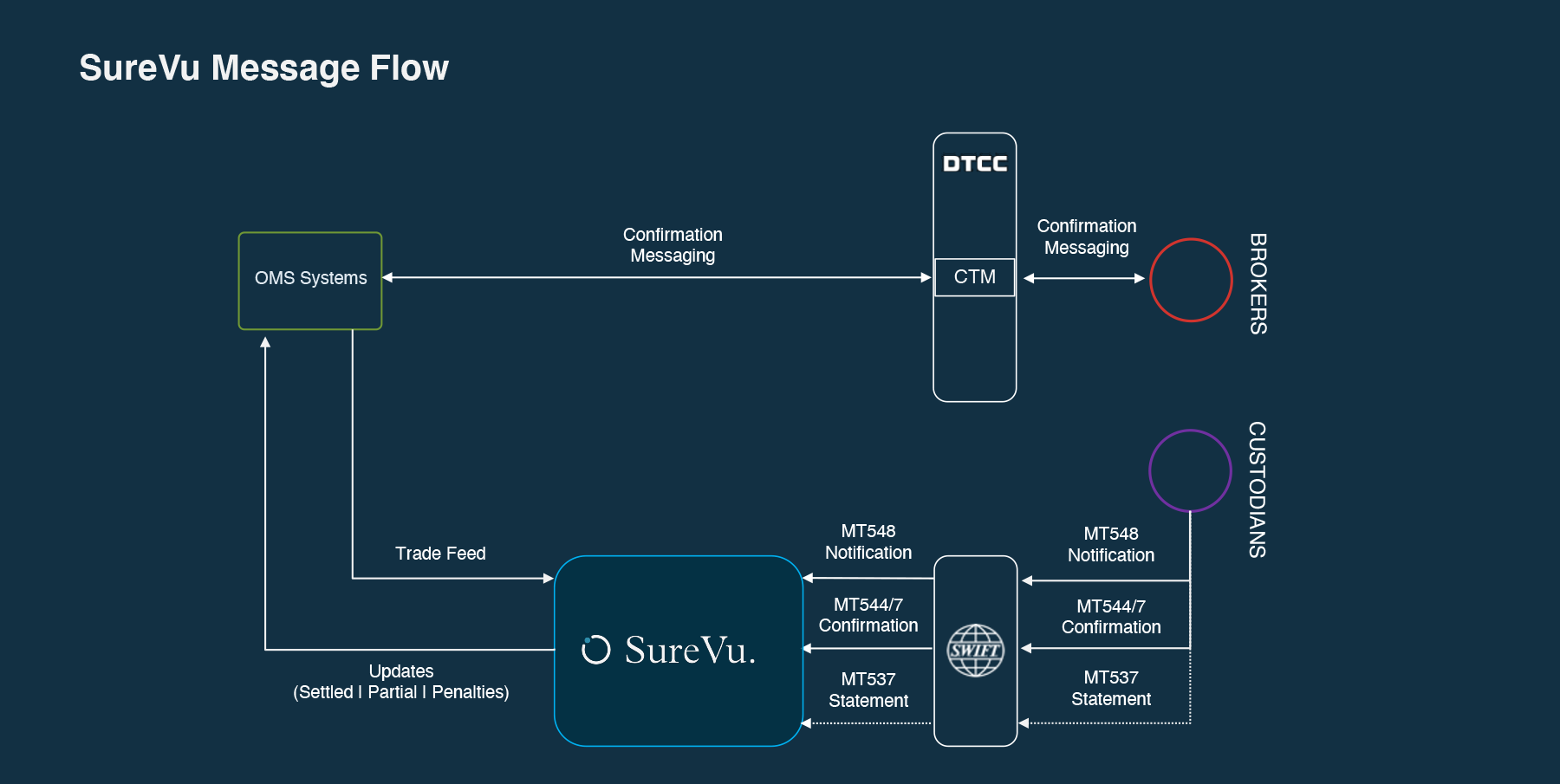

Stay informed – receiving intraday custodian status notifications via real-time SWIFT messages. Operations Managers have full oversight of any issues within the settlement chain, identifying potential daily penalties instantly.

Governance and controls – reduce risk, costs, and inefficiencies of all trading parties to ensure compliance with the latest CSDR regulations associated with the Settlement Discipline Regime.

Failed trade management, partial settlement management and penalty fee reporting in one solution.

Know the cost – penalty fees are reported daily and netted monthly by custodians. As users are kept fully appraised of trade status through the full trade lifecycle there are very few reasons why most trades cannot be matched before settlement date to avoid the costly penalties introduced by the CSDR.

…all essential factors when firms consider the move to T+1 settlement.

SureVu is ready – are you?

common challenges and solutions

Compliance with the CSDR Settlement Discipline Regime

Multiple systems tracking trade failures

Uncertainty over settlement risk

SureVu highlights

Automation of the full settlement lifecycle

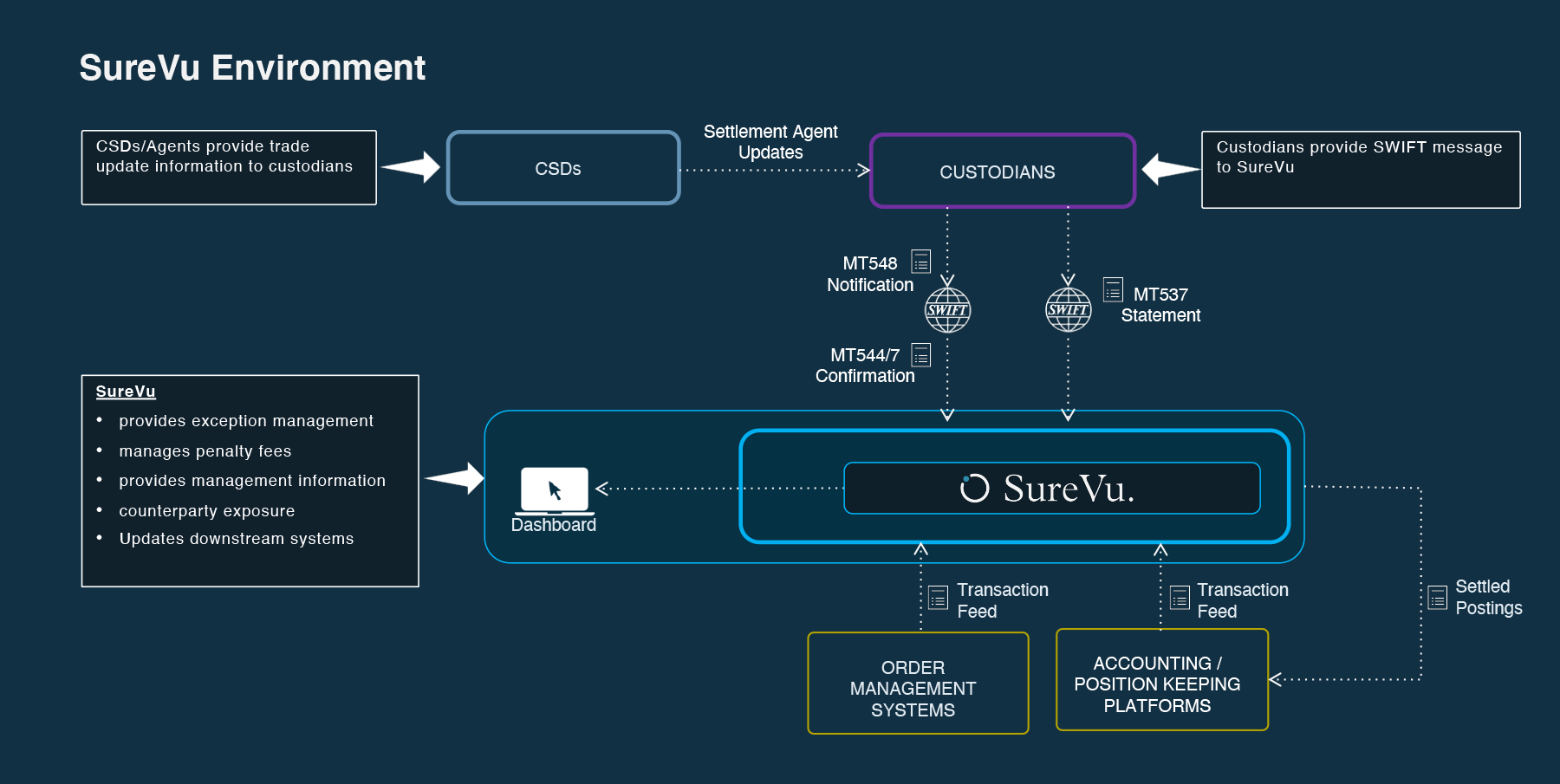

Pre-settlement and failed trade monitoring are still manual processes for many trading parties. With the introduction of SDR, Operations teams need to proactively monitor the pre-matching of every trade. This helps ensure settlement and mitigate the operational risk of settlement failure that results in increased manual workload and costs. This risk mitigation will be essential when the market moves to T+1 settlement.

SureVu fully automates the process by managing communications from custodians via SWIFT messages. By employing our proven trade processing exception management facilities, users are rapidly presented with the most critical issues and the means to manage them.

Managing cash penalty fees

With the introduction of cash penalties even more pressure is being put on buy-side firms to have solid pre-settlement and failed trade management processes. Even so, daily penalties are two-way in value (debits and credits) and such fees need to be reconciled. SureVu reports daily and monthly penalties data sent by custodians to assess the net value of penalty fees applied to portfolios or funds monthly.

Show that you are in control

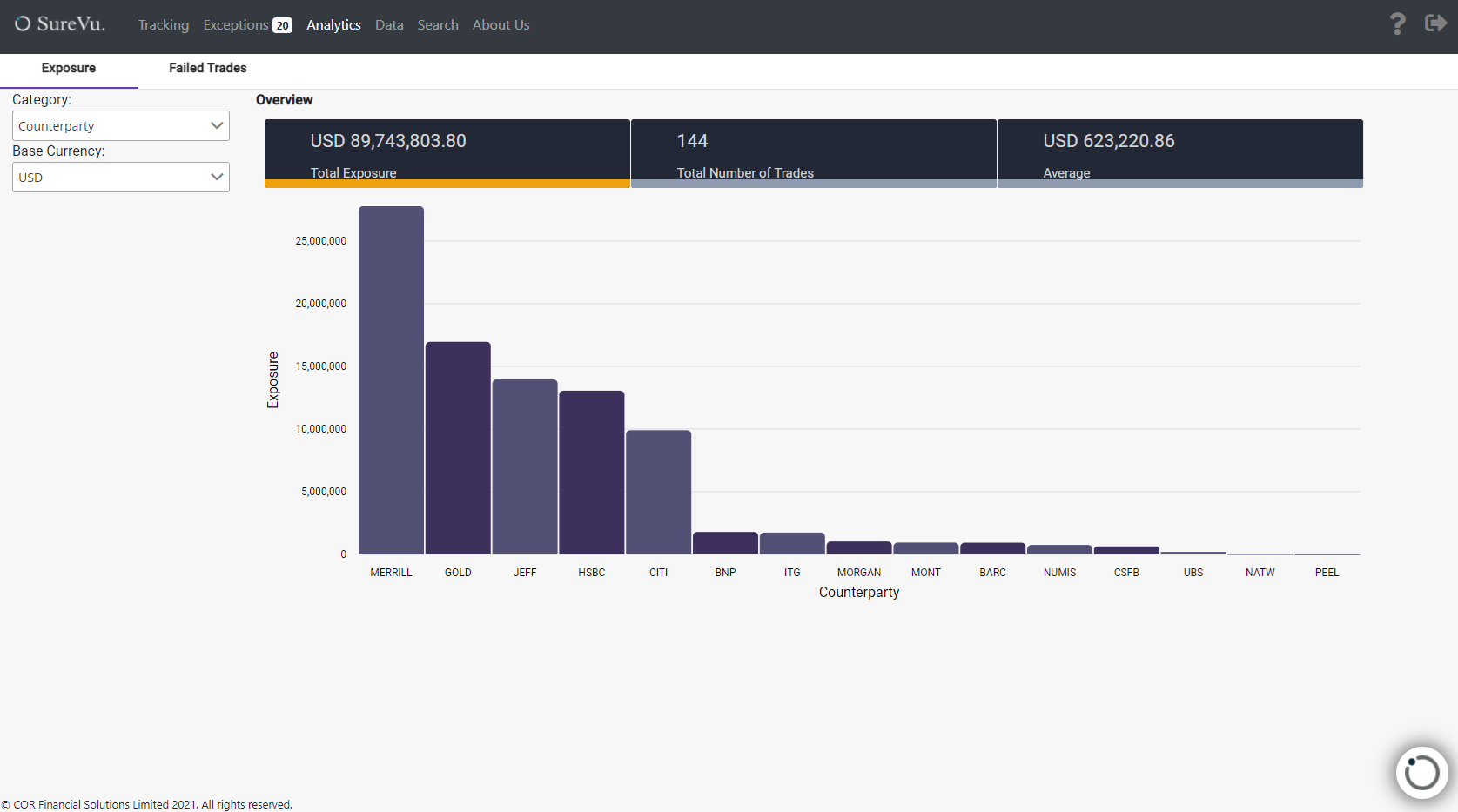

One of the key learnings from the Lehman collapse was the lack of data concerning various market exposures. In addition to managing outstanding settlements and moving them toward completion, SureVu shows you all your unsettled trade risk based on your own data – not information derived by third parties – reflected on a single management dashboard.

key benefits

Get compliant and avoid penalties

Simplify failed trade management

Avoid the tedious manual process of checking data from different systems, data sources and counterparties. Have a view of the complete chain of settlement events and manage them by exceptions within one settlement infrastructure. With the right options and controls to hand, issues can be resolved quickly, with full audit visibility.

Avoid and manage penalty fees

Manage settlement exposure

Manage exposure to unsettled trades at a counterparty, market, or stock level. Avoid the operational risk of not knowing when it really matters.

Governance and cost saving

Streamline and standardise trade settlement monitoring. SureVu brings governance, control, and consistency to the failed trade management processes, which together reduce operational risk and increase efficiency. Your firm will also be complying with regulations such as CSDR and reducing its costs.

how it works

A standard model for all...

SureVu is built on a standard model principle, with all functions available to our entire client base. This means that all developments, enhancements, and updates are merged into our standard model enabling all clients to benefit from our ongoing innovation.

Our standard model also enables fast implementation times. A project can be complete in a matter of weeks for a standard installation, with predictable, low risk integration and minimised people costs. This enables fixed price implementations without the risk of long running projects (associated with solutions that have to be built or heavily configured before they reach a production state).

We think using a local record of trades is essential if you want to fully control and govern ALL of your trade positions based on your own data rather than that derived from other parties. Nothing less will do…