Settlement management software used globally by major asset managers, hedge funds and outsource administrators to streamline trade processing and mitigate operational risk

in brief

A trade processing system combining matching & confirmation, settlement instruction processing, and failed trade management into a single solution to meet T+1 settlement needs, today

Salerio, a modular, multi-asset class settlement software solution, deployed as a middle office platform by global investment managers, hedge fund managers, asset owners, sovereign wealth managers and outsourced service providers (TPAs). Salerio focuses on what matters most; getting trades confirmed, processed and settled no matter how high the trade volumes are.

Execute with confidence – mitigate operational, counterparty and settlement risk that comes with a trail of communications via email, phone or even fax messages. Our exception management hub provides trade matching, confirmation, settlement messaging, settlement tracking and failed trade management for securities, exchange traded futures, repos, foreign exchange, and money markets and cash transactions.

Centralize processing – complete visibility of problematic transactions from trade data validation and matching, to managing settlement instructions and notifications to all parties, you have pre-defined user options to resolve issues quickly, accurately, and efficiently via a single dashboard with a full audit trail.

Scalability and efficiency – integrated seamlessly with the DTCC CTM™ service, alongside SWIFT message management, Salerio creates a scalable exception management workflow process across multiple asset types delivering mission critical capabilities and governance to know where issues are before trades fail and be SDR compliant.

These are all essential factors when firms consider the move to T+1 settlement.

common challenges and solutions

Route to T+1 settlement

When the industry loses a processing day – effective and efficient exception management and enhanced processing features are essential for timely management and failed trade governance. Salerio provides the route to the new generation trade lifecycle.

CSDR settlement risk management

Failed trade management means avoidance not reconciliation. Governance and controls are mandatory to ensure regulatory compliance with the latest CSDR changes associated with the Settlement Discipline Regime. Failed trade management, partial settlement and penalty payment processing are covered by Salerio.

The shortening of the settlement cycle will present buy-side firms with some severe operational challenges. Watch our video here and learn how Salerio can assist your firm in preparing for T+1.

Salerio highlights

Reduce risk, costs, and inefficiencies for all stakeholders

Through automation across the trade settlement lifecycle. Let the machine work for you in minimizing counterparty risk and improving your operating model.

Remove the need for multiple systems/workstations

Centralizing mission-critical trade processing into a single hub.

Save time with exception management

On average, 95% straight through processing, without any effort or intervention from users (a must for a T+1 lifecycle).

Operate with complete confidence 100% of the time

A truly reliable, best in-class system.

Trade confirmation and local matching

Salerio provides a truly global trade management solution across multiple asset classes, dealing with both blocks and the allocation of trades. It interfaces seamlessly with DTCC’s CTM™ service to manage securities confirmation and matching events within its central hub. Local matching of trade records from counterparties supports asset types such as exchange trades futures. Foreign exchange matching and confirmation is automated via SWIFT messages from counterparties.

Trade settlement and messaging

Salerio generates validated settlement instructions in SWIFT, email and fax formats. It validates Standard Settlement Instructions (SSI) via a locally stored database. This approach ensures accuracy, which in turn significantly reduces settlement risk in line with CSDR regulations.

Trade tracking (failed trade management)

Salerio tracks settlement status updates received from custodians and their clearing agents via SWIFT messages, providing users with a real-time view of all pre-settlement and failed trade issues. Users can track failed trades, along with partial settlements effectively, thereby greatly reducing the risk of cash penalty fees.

We also have a standalone failed trade management system called SureVu.

“It is not about managing failed trades – it is knowing when they are ready to settle.”

Cash payments management

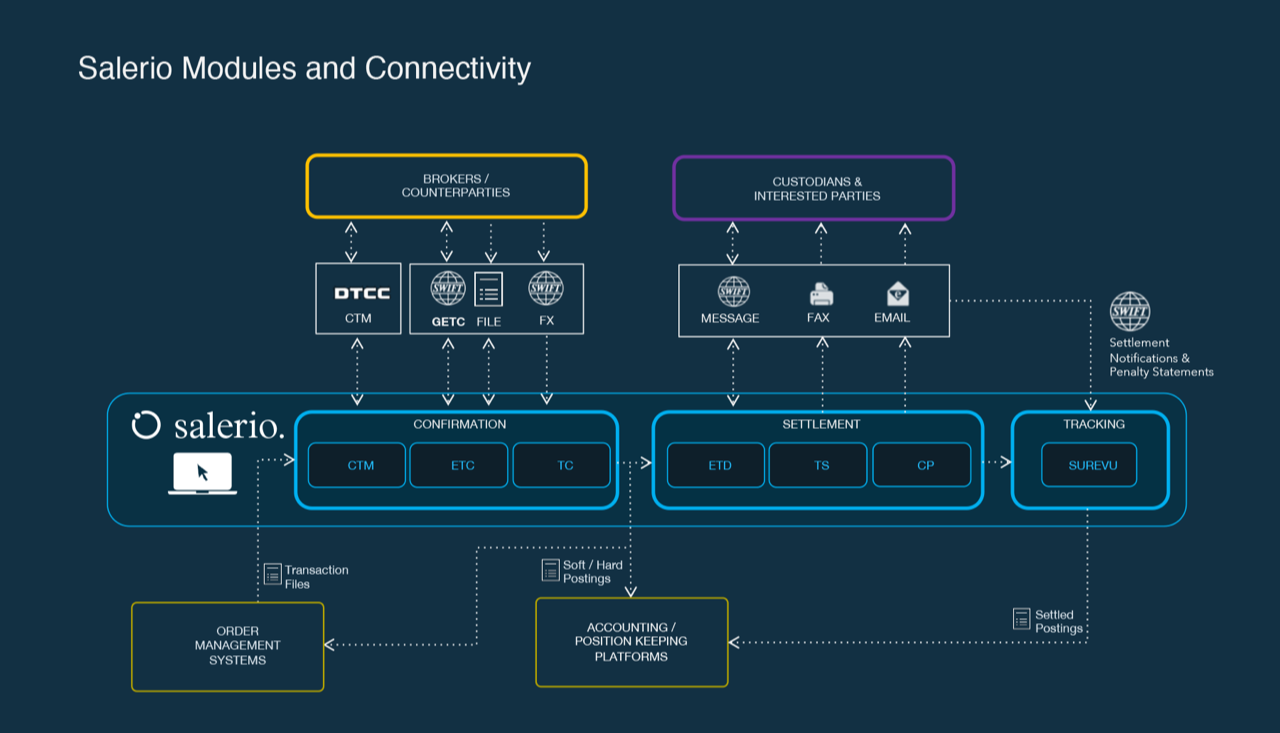

Salerio Modules and Connectivity

Salerio supports three business processes within the middle office operating model: confirmation, settlement and failed trade management. Within those business functions are modules performing different tasks. Salerio integrates internal platforms (order management, accounting and position keeping) and information from external parties (brokers, counterparties, custodians and interested parties).

MODULES:

CTM: CENTRAL TRADE MATCHING & CONFIRMATION (SECURITIES)

ETC: LOCAL MATCHING (SECURITIES / EXCHANGE TRADED FUTURES)

TC: TREASURY MATCHING & CONFIRMATION (FX & MONEY MARKETS)

ETD: ELECTRONIC TRADE DELIVERY (SECURITIES MESSAGING)

TS: TREASURY SETTLEMENT (FX & MONEY MARKETS MESSAGING)

CP: CASH PROCESSING (PAYMENTS MESSAGING)

SUREVU: FAILED TRADE MANAGEMENT (including CSDR – SDR)

key benefits

Governance

Brings governance, control, and consistency to trade processes, which together reduces settlement risk and increases operational efficiency. This facilitates the management of regulatory risk, while complying with key regulation such as CSDR.

Scalability

Reduces high volume traffic to exceptions management protocols, releasing operational staff to focus on important issues. Up to 30,000 trades a day are easily managed by two or three people.

Simplification

Avoids tedious processes associated with the manual checking data from different systems, data sources and counterparties. Have a view of the complete chain of events and manage them by exceptions. With the right options and controls to hand, issues are resolved quickly, with full audit visibility.

Deployment

Salerio is not a toolkit, it is a complete, quick to implement modular solution, built on a standard model approach. Whether installed on a local network or hosted in a private cloud, each Salerio module can be installed in weeks, not months.

how it works

A standard model for all

The days of lengthy projects with long drawn-out product and user configuration for your business and IT teams – even before detailed UAT activities, must be put behind us. Solutions need to be quick and easy to deploy by the companies that buy them.

Salerio is a working product built on standard model principles, with all modules available to our entire client base and easily controlled by licence agreements. This enables fast implementation times for each Salerio module with predictable implementation costs.

Salerio also provides an easy upgrade path, with new functionality and the latest technology available for implementation without fuss, always keeping your teams on top of new developments.

Move quickly and with confidence – remove the fear of those dreaded, open-ended IT projects that all too often never seem to close properly, be on time or within budget.