advanced suitability, investment & governance solutions

Transforming wealth management through better insight and analysis

in brief

Powering the future of wealth management, supporting advisors, investment teams and governance divisions. BITA Wealth delivers a better client and advisor experience through improved insight, efficiency, oversight and control

BITA Risk®, with client AUM of over £160bn, is part of the corfinancial™ group. Its BITA Wealth application is innovative, award-winning software for high and ultra-high net worth wealth managers. BITA Wealth provides investment teams, advisors / managers, and governance divisions with the tools they need to develop and grow their businesses in a controlled way. Suitable for wealth management firms, broker-dealers, private banks, trust companies and family offices. Designed to integrate on a modular or end-to-end basis to easily enhance your existing IT Architecture, maximising the return on existing investment, its modules include:

New challenges in Portfolio Governance and Management

BITA Risk’s study into the current challenges facing wealth managers in portfolio governance and management revealed 5 key areas needing action: TCFD, ESG, Consumer Duty, Central Investment Plans and Risk and Suitability.

Quick efficient analysis and aggregation of data at scale, with seamless and efficient workflows for governance and client managers alike is at our core. Read below to discover how we can help you meet these new challenges with pre-trade and post trade analysis and monitoring ensuring compliance and delivering management information and governance reporting.

TCFD – automated TCFD reporting – a scalable TCFD reporting and portfolio carbon management solution that reduces effort, data complexity and costs for you, but most importantly ensures you can meet the regulatory reporting requirements and add value to your client relationship through clear reports and demonstrable trends.

ESG – delivering your sustainable investment policy – powerful visualisations simplify complex ESG data to tell a clear story for every client in the context of your firm’s sustainable policy and their individual requirements. ESG What-if allows you to see instantly the impact of any portfolio change and discuss it with the client. Multiple sources of data are easily combined in a single portfolio view of ESG analytics. Client preference capture supports an individual’s needs and ensures they are always monitored and met.

Consumer duty – MI and exception reporting across foreseeable harm and outcomes In broad scope of Consumer Duty management information and demonstrable process are key. With daily exception monitoring across key foreseeable harm metrics and analysis and consistency checks on portfolio outcomes, BITA Wealth has got this covered, in an efficient safe way.

Central Investment Plans – delivering and managing the exceptions – in every firm there are portfolios outside the plan. Being able to identify and rectify issues before they become problems both reduces your compliance risk and the chance of negative outcomes for consumers leading to everyone benefiting from a forward-thinking approach. With know exception recording and over 40 test metrics, we go beyond just risk and drift and ensure your CIP is delivered.

Risk and suitability governance – getting the fundamentals right – asset allocation drift or risk are not enough if you want to understand the true nature of a portfolio. Holding based portfolio metrics volatility and other risks should be used to deliver enterprise oversight and control – enabling firms to better manage the risks of portfolios and delivering consistent outcomes. Managers need to be empowered with intuitive, relevant portfolio analytics. Underpinned by full exception management and approval processes BITA Wealth Monitor helps firms grow through demonstrable risk management, improved client retention, better M&A impact analysis, and protection against reputational risks.

common challenges and solutions

Meeting evolving ESG reporting requirements

Enterprise portfolio governance

Investment analytics and reporting

The operational challenges for wealth managers implementing TCFD

BITA Wealth delivers the scale, sophistication and depth needed to meet the demands of wealth management firms today and into the future

BITA Wealth Profiler

Understand clients in a way few others do, and give clients an understanding that few others can.

BITA Wealth Profiler considers the multiple aspects of a client’s investment needs and builds an investment profile that combines risk, suitability and ESG preferences. Supporting client segmentation and reporting across different countries, regions, client types, and business units, and systematically mapping client profiles across a firm’s investment offering, via both direct and intermediary business channels.

Supporting scalability and growth through the efficient, automated production of high quality investment proposal and annual review reports, BITA Wealth Profiler helps deliver consistent client outcomes, process automation, improved efficiency and transparency whilst retaining advisor autonomy.

- Investor profiling, incorporating risk, suitability & ESG preferences

- Systematically map client profiles to a firm’s investment proposition

- Incorporate KYC / Factfind

- Supports enterprise-wide segmentation and branching across business streams / client types

- Supports Annual Review reporting / workflows

- Delivers high quality bespoke Investment Proposals

- Supports complex mandates

- Management information and trend analysis

BITA Wealth Portfolio Analytics

Underpinned by institutional strength risk capabilities and risk models, the BITA Wealth Portfolio Analytics module empowers advisors and investment teams by delivering ‘deep dive’ portfolio analytics and reporting across client, prospect, and model portfolios.

Dynamic portfolio analytics include factor exposures, ESG analytics, stress testing, and portfolio optimisation capabilities. Supporting the automated upload of portfolio positions and bulk reporting across models and individual portfolios, the BITA Wealth Portfolio Analytics module can also link to client suitability profiles to deliver pre-trade compliance what-if analytics and monitoring.

- Portfolio Modelling & ‘What-if’ analysis

- Portfolio Optimisation

- Factor Analysis & Stress Testing

- Performance Monitoring Analytics

- Model Management

- Buy-list Management

- Trade Export

- Investment recommendation workflows

- Pre-trade compliance checks

- Automated Portfolio Reporting

BITA Wealth ESG Manager

BITA Wealth adds practical ESG management to existing investment propositions, supporting a manageable, graduated approach to delivering sophisticated ESG investment analytics and client reporting. It delivers full ESG risk exposure and analysis reporting, captures investor ESG preferences and monitors the portfolio against them. What-if portfolio modelling includes detailed ESG analytics, allowing the effect of ESG overlays on a portfolio to be understood.

- Investor ESG preference capture & management

- Full ESG exposure analysis and reporting

- Carbon reporting

- ESG ‘what-if’ factor screening & analytics

- ESG data management & aggregation

- Dynamic ESG conflict monitoring

- Integrated exception management & approval processes

BITA Wealth Monitor

Delivering enterprise-wide daily portfolio monitoring against risk, IPS, mandate and investment policy tolerances. This module delivers enterprise oversight and control – enabling firms to efficiently manage the risks of portfolio drift, whilst empowering advisors with intuitive, relevant portfolio analytics that deliver managers freedom within an investment framework, supporting the delivery of consistent client outcomes. Underpinned by full exception management and approval processes, BITA Wealth Monitor helps firms grow through demonstrable risk management, improved client retention, better M&A impact analysis, and protection against reputational risks.

- Detailed portfolio insight & analysis

- Integrated exception management & approval processes

- Centralised investment oversight

- M&A impact analysis and oversight

- Performance Monitoring information

- Detailed trend, pattern and MI analytics

- Supports regulatory best practice

- REG-9 automation

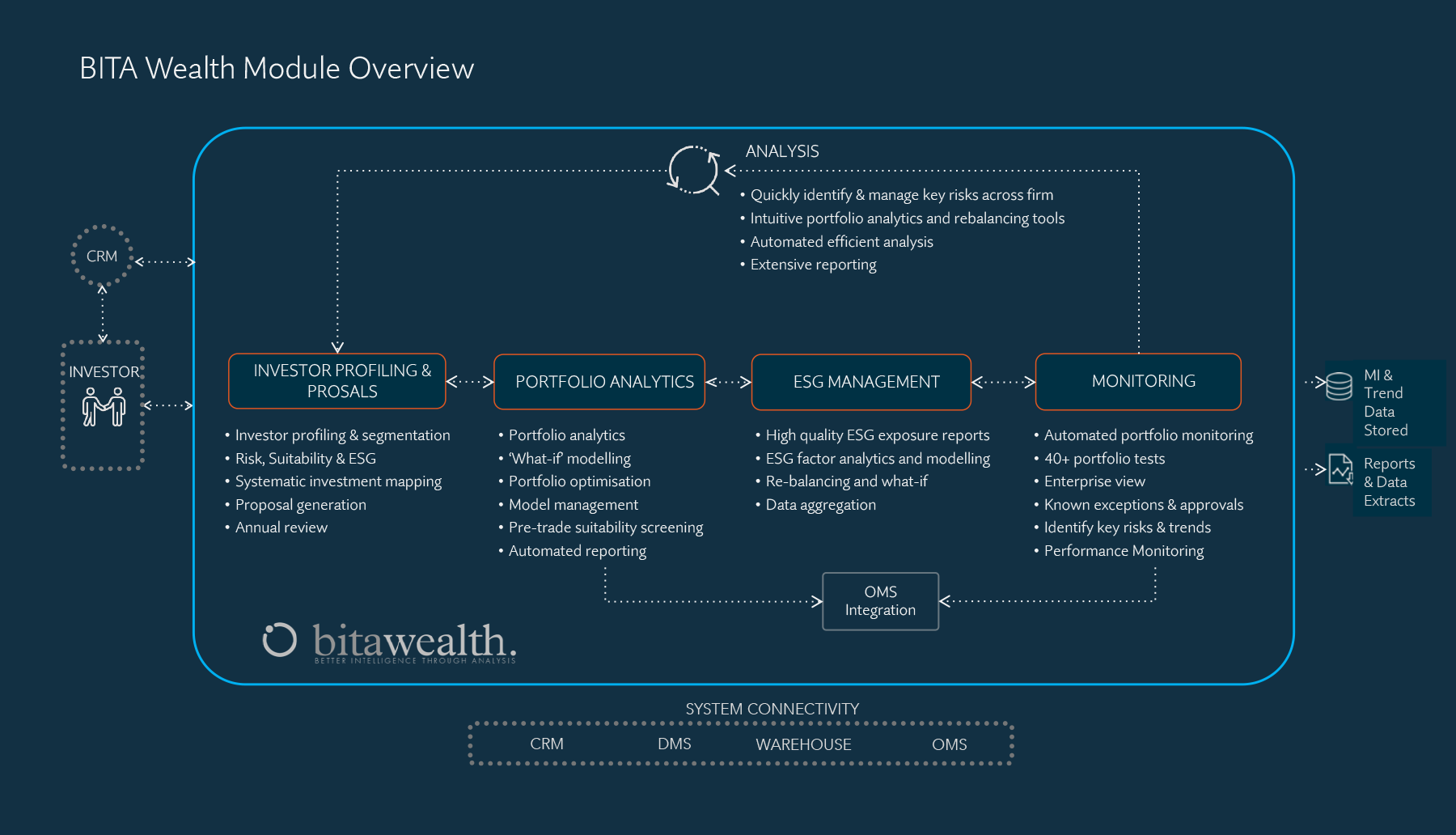

BITA Wealth Module Overview

BITA Wealth supports investor profiling and proposals, portfolio analytics, ESG management, and monitoring. The modules can interface with a CRM, DMS, data warehouse or OMS, in addition to the investor.

BITA Wealth Profiler considers the multiple aspects of a client’s investment needs and builds an investment profile that combines risk, suitability and ESG preferences.

BITA Wealth Portfolio Analytics empowers advisors and investment teams by delivering ‘deep dive’ portfolio analytics and reporting across client, prospect, and model portfolios.

BITA Wealth ESG Manager delivers full ESG risk exposure and analysis reporting, captures investor ESG preferences and monitors the portfolio against them.

BITA Wealth Monitor facilitates enterprise-wide daily portfolio monitoring against risk, IPS, mandate and investment policy tolerances.

BITA Risk highlights

Save time through automated efficiency

Deliver your team instant access to portfolio analytics, reporting and enterprise-wide portfolio monitoring.

Empower advisors

Deliver relevant, useful workflows and portfolio analytics to advisors’ desktops – delivering freedom within an investment framework and supporting consistent client outcomes.

Support central investment teams

Support centralised investment insight and analytics and deliver the infrastructure and confidence to scale across a new client segments, investment teams or businesses.

Enrich your existing infrastructure

Implementing an industry leading suitability framework removes the need for full, expensive system replacement – quickly and easily enhance your existing infrastructure without rewriting the process.

Portfolio analytics and insight

Automate the upload, analysis and reporting across portfolio and models.

key benefits

Integrate ESG

Supporting the evolution of your ESG policy, delivered through detailed investment analytics and considered within the context of BITA Wealth’s industry leading suitability framework.

Manage business risk

Immediately identify risks, monitor trends, and understand patterns – know the risks that are lying in wait, and have the tools in-house to effectively manage, analyse and report on them.

Support M&A activity

Effective business transformation – easily assess and on-board a new book of business. Combining enterprise oversight and portfolio insight ensures firms can quickly analyse the impact of transformational change, M&A activity, or policy changes.

Deliver consistent client outcomes

Ensure regulatory best practice by empowering managers and providing efficient, useful workflows and analytics.

Avoid black box processes and solutions, instead build client trust and create a solid foundation for a long-term investment relationship.

Investment proposal generation

Drive growth through the delivery of high-quality profile, annual review and investment proposals to clients. Retain clients, protect reputation and appeal to more complex mandates. Ensure an entirely scalable infrastructure that drives growth through prioritising client retention and regulatory best practice.

Quick deployment

how it works

A straightforward and simple approach

Solutions need to be quick and easy to deploy by the companies that buy them. BITA Wealth is a working product not a toolkit; it is a fully built and functional parameter-based system, enabling faster implementation and predictable implementation costs.

BITA Wealth can be installed on physical servers on a local client network or deployed on virtual machines provided on private cloud facilities from third-party service providers.

Compliance, Risk & Oversight Monitoring

Portfolio, Risk and Model Management

BITA Wealth provides rapid assessment of a current portfolio and ‘what-if’ changes against risk, policy, model and IPS/mandate, before exporting trades.

Client Suitability Profiling and Proposals

BITA Wealth uses its proven multi-facet questionnaire, scoring and profiling process to match a client’s profile to the investment proposition of a firm and set the mandate.

ESG Practical Management

BITA Wealth brings practical ESG management to your desktop through four easy steps.