advanced private wealth governance, suitability, risk and investment management solutions in the cloud or on-premise

Transforming wealth management through better insight and analysis

in brief

Powering the future of wealth management, supporting managers, advisors, governance and investment teams. BITA Wealth® delivers a better client and manager/advisor experience through improved insight, efficiency, oversight and control of portfolio risk and construction.

BITA Risk®, providing software to clients who manage AUM of over £180bn, is part of the corfinancial® group. Its modular BITA Wealth application is innovative, award-winning software for all wealth managers. Available as a secure, cloud hosted solution or on-premise, BITA Wealth provides advisors and managers and governance and investment teams with the tools they need to develop and grow their businesses in an efficient, controlled way. BITA Wealth is suitable for wealth management firms, broker-dealers, private banks, bank trusts and family offices. It is also designed to integrate on a modular or end-to-end basis to easily enhance your existing IT architecture, maximising the return on existing investment. Its modules include:

Challenges in Portfolio Governance and Management

BITA Risk’s study into the key challenges facing wealth managers highlighted time and regulatory risk (whether Consumer Duty in the UK or REG-9 in the US). Efficient use of front office time and oversight control in meeting regulation are the key areas needing action – often involving too much manual intervention and outdated legacy systems. Success can be measured as identifying and mitigating foreseeable harm and managing to good outcomes. To do this a firm needs to understand its clients’ requirements, implement the appropriate investment proposition, incorporate specific requirements and manage exceptions; this is where BITA Wealth and BITA REG-9™ help you capture, deploy, manage and control.

Quick efficient analysis and aggregation of data at scale, with seamless and efficient workflows for governance and client managers alike is at our core. Read below to discover how we can help you meet these new challenges with pre-trade and post-trade analysis and exception management, along with monitoring, ensuring compliance and delivering management information and governance reporting.

UK: Consumer Duty – management information (MI) and exception and audit reporting across foreseeable harm and outcomes. In the broad scope of Consumer Duty, management information and demonstrable processes are key. With daily exception monitoring across key foreseeable harm metrics and analysis and consistency checks on portfolio outcomes, BITA Wealth has got this covered, in an efficient safe way, enabling you to answer key regulatory questions.

US: REG-9 – bringing automation to ‘Initial’, ‘Admin. REG-9’ and ‘Unique Asset Reviews’ and reporting. Building on BITA Wealth’s portfolio analytics and exception monitoring, BITA REG-9 provides a new systematic REG-9 and Admin review process. Representing a leap forward in efficiency in REG-9 controls and governance, it provides flexible reviews, plus portfolio monitoring, joined with risk management and performance dispersion, in a single application and holistic report. This significantly lowers manual effort, reduces risk, and provides audit, control and insight into your business.

Central Investment Propositions – delivering and managing the exceptions – in every firm there are portfolios outside the plan. Being able to identify and rectify issues before they become a problem both reduces your firm’s compliance risk and the chance of negative outcomes for its clients, leading to everyone benefiting from a proactive forward-thinking approach. With known exception recording/reporting and over 40 test metrics, we go beyond just risk and drift and ensure your CIP is delivered. Bespoke client mandate portfolios are similarly checked with the same automation.

Risk and suitability governance – getting the fundamentals right – asset allocation drift or risk are not enough if you want to understand the true nature of a portfolio. Holdings based portfolio metrics volatility and other risks should be used to deliver enterprise oversight and control – enabling firms to better manage portfolio risk and delivering consistent outcomes. Managers need to be empowered with intuitive, relevant portfolio analytics. Underpinned by full exception management and approval processes BITA Wealth Monitor™ helps firms grow through demonstrable risk management, improved client retention, better M&A impact analysis, and protection against reputational risks.

TCFD – automated TCFD reporting – a scalable TCFD reporting and portfolio carbon management solution that reduces effort, data complexity and costs for you, but most importantly ensures you can meet the regulatory reporting requirements and add value to your client relationship through clear reports and demonstrable trends.

Sustainability – delivering your investment policy – powerful visualisations simplify complex ESG data to tell a clear story for every client in the context of your firm’s sustainable policy and their individual requirements. ‘What-if’ allows you to see instantly the impact of any portfolio change and discuss it with the client. Multiple sources of data are easily combined in a single portfolio view of sustainable analytics. Client preference capture supports an individual’s needs and ensures they are always monitored and met. Automation from capture through to monitoring and sending restrictions to other systems complete the process.

Portfolio monitoring

common challenges and solutions

Enterprise portfolio governance

Investment analytics and reporting

Meeting evolving Sustainability reporting requirements

Transform your REG-9 compliance management!

Introducing BITA Risk

The operational challenges for wealth managers implementing TCFD

BITA Wealth delivers the scale, sophistication and depth needed to meet the demands of wealth management firms today and into the future. Available on-premise or in the cloud.

BITA Wealth Monitor™

Delivering enterprise-wide daily portfolio monitoring against risk, IPS, mandate and investment policy tolerances. This module delivers enterprise oversight and control – enabling firms to efficiently manage the risks of outlier portfolios, whilst empowering managers and advisors with intuitive, relevant portfolio analytics that enable freedom within an investment framework, supporting the target of consistent client outcomes. Underpinned by full exception management and approval processes, BITA Wealth Monitor helps firms grow through demonstrable risk management, improved client retention, better M&A impact analysis, and protection against reputational risks.

- Enterprise governance oversight drilling down to detailed portfolio insight & analysis

- Integrated exception management & approval processes

- Central investment proposition oversight

- Performance dispersion analysis and reporting

- Detailed trend, pattern and Management Information (MI) analytics

- M&A impact analysis and oversight

- Supports regulatory best practice

BITA REG-9™

BITA Wealth offers an integrated REG-9 workflow, bringing portfolio rules and admin checks together in one place, driving efficiency and insight through the automated Review Report and approval process. With portfolio rules being checked daily, with only exceptions reported, a firm knows where they are compliant, and where there are actions needed.

BITA REG-9 provides instant enterprise oversight and reporting at all levels from compliance through branch and team heads to individual advisors. Reviews due or needing action are flagged and an easy workflow enables rapid completion. Not only can you stay on top of issues, but you can easily report status for audits and management, giving complete control.

- ‘Initial’, ‘Admin. REG-9’ and ‘Unique Asset’ checklists and auto report generation

- Ensure continuous compliance with automated checklist and rule-checking

- Central oversight and control: monitor review completion, reports due and exceptions across all portfolios

- Auditable report approval workflow

- Pre- and post-trade checks for better exception management

- Efficiency across teams: managers and compliance share the same source of data

- One source of admin, portfolio, risk and performance data for complete oversight, audit reports and governance control

BITA Wealth Profiler™ and IPS

Understand clients in a way few others do, and give clients an understanding that few others can.

BITA Wealth Profiler considers the multiple aspects of a client’s investment needs and builds an investment profile that combines risk, suitability and portfolio preferences. Supporting client segmentation and reporting across different countries, regions, client types, and business units, and systematically mapping client profiles across a firm’s investment offering, via both direct and intermediary business channels.

Supporting scalability and growth through the efficient, automated production of a high-quality investment proposal (IPS) and annual review reports, BITA Wealth Profiler helps deliver consistent client outcomes, process automation, improved efficiency and transparency whilst retaining advisor autonomy.

- Investor profiling, incorporating risk, suitability & ESG preferences

- Systematically map client profiles to a firm’s investment proposition

- Incorporate KYC / Factfind

- Supports enterprise-wide segmentation and branching across business streams / client types

- Supports Annual Review reporting / workflows

- Delivers high quality bespoke Investment Proposals (IPS)

- Supports complex mandates

- Management information and trend analysis

BITA Wealth Portfolio Analytics™

Underpinned by institutional strength risk capabilities and risk models, the BITA Wealth Portfolio Analytics module empowers advisors and investment teams by delivering ‘deep dive’ portfolio analytics, construction tools and reporting across client, prospect, and model portfolios.

Dynamic portfolio analytics include factor exposures, ESG analytics, stress testing, and portfolio optimisation capabilities. Supporting the automated upload of portfolio positions and bulk reporting across models and individual portfolios, the BITA Wealth Portfolio Analytics module can also link to client suitability profiles to deliver pre-trade compliance what-if analytics and monitoring.

- Portfolio Modelling & ‘What-if’ analysis

- Portfolio Optimisation

- Factor Analysis & Stress Testing

- Performance Monitoring Analytics

- Model Management

- Buy-list Management

- Trade Export

- Investment recommendation workflows

- Pre-trade compliance checks

- Automated Portfolio Reporting

BITA Wealth ESG Manager™

BITA Wealth adds practical sustainability management to existing investment propositions, supporting a manageable, graduated approach to delivering sophisticated ESG investment analytics and client reporting. It delivers full ESG risk exposure and analysis reporting, captures investor ESG preferences and monitors the portfolio against them. What-if portfolio modelling includes detailed ESG analytics, allowing the effect of ESG overlays on a portfolio to be understood.

- Investor ESG preference capture & management

- Full ESG exposure analysis and reporting

- Carbon reporting

- ESG ‘what-if’ factor screening & analytics

- ESG data management & aggregation

- Dynamic ESG conflict monitoring

- Integrated exception management & approval processes

Introducing BITA Wealth ESG Manager™

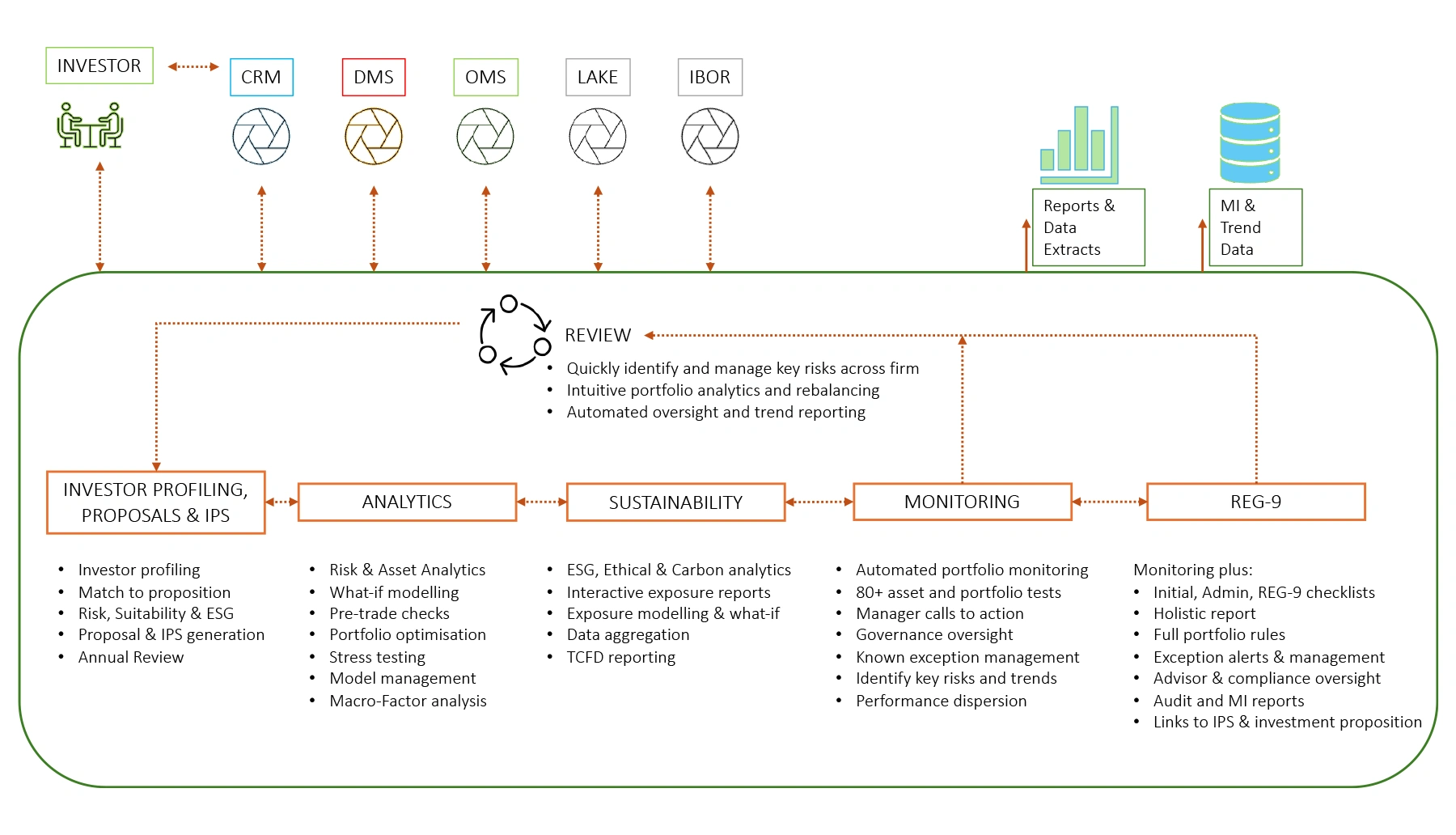

BITA Wealth Module Overview

BITA Wealth supports investor profiling and proposals, portfolio analytics, ESG management, and monitoring. The modules can interface with a CRM, DMS, data warehouse or OMS, in addition to the investor. All modules are available via an installation or cloud hosted service by corfinancial.

BITA Wealth Profiler considers the multiple aspects of a client’s investment needs and builds an investment profile that combines risk, suitability and ESG preferences.

BITA Wealth Portfolio Analytics empowers advisors and investment teams by delivering ‘deep dive’ portfolio analytics and reporting across client, prospect, and model portfolios.

BITA Wealth Monitor facilitates enterprise-wide daily portfolio monitoring against risk, IPS, mandate and investment policy tolerances.

BITA REG-9 offers an integrated REG-9 workflow, bringing portfolio rules and admin checks together in one place, driving efficiency and insight.

BITA Wealth ESG Manager (Sustainability) delivers full ESG risk exposure and analysis reporting, captures investor ESG preferences and monitors the portfolio against them.

BITA Wealth highlights

Save time through automated efficiency

Deliver your team instant access to portfolio analytics, reporting and enterprise-wide portfolio monitoring.

Empower advisors

Deliver relevant, useful workflows and portfolio analytics to advisors’ desktops – delivering freedom within an investment framework and supporting consistent client outcomes.

Support central investment teams

Support centralised investment insight and analytics and deliver the infrastructure and confidence to scale across new client segments, investment teams or businesses.

Enrich your existing infrastructure

Implementing an industry leading suitability framework removes the need for full, expensive system replacement – quickly and easily enhance your existing infrastructure without rewriting the process.

Portfolio analytics and insight

Automate the upload, analysis and reporting across portfolio and models.

key benefits

Integrate ESG

Supporting the evolution of your ESG policy, delivered through detailed investment analytics and considered within the context of BITA Wealth’s industry leading suitability framework.

Manage business risk

Immediately identify risks, monitor trends, and understand patterns – know the risks that are lying in wait, and have the tools in-house to effectively manage, analyse and report on them.

Support M&A activity

Effective business transformation – easily assess and on-board a new book of business. Combining enterprise oversight and portfolio insight ensures firms can quickly analyse the impact of transformational change, M&A activity, or policy changes.

Deliver consistent client outcomes

Ensure regulatory best practice by empowering managers and providing efficient, useful workflows and analytics.

Avoid black box processes and solutions, instead build client trust and create a solid foundation for a long-term investment relationship.

Investment proposal generation

Drive growth through the delivery of high-quality profile, annual review and investment proposals to clients. Retain clients, protect reputation and appeal to more complex mandates. Ensure an entirely scalable infrastructure that drives growth through prioritising client retention and regulatory best practice.

Quick deployment

The BITA Wealth modules enable firms to easily enhance their existing infrastructure without rewriting all their processes or embarking upon costly, lengthy system replacements.

how it works

A straightforward and simple approach

Solutions need to be quick and easy to deploy by the companies that buy them. BITA Wealth is a working product not a toolkit; it is a fully built and functional parameter-based system, enabling faster deployment and predictable implementation costs.

BITA Wealth is available as a hosted solution through Microsoft Azure, with the added security of a single tenant per firm. Alternatively, it can be installed on physical servers on a local client network or deployed on virtual machines.

Compliance, Risk & Oversight Monitoring

Portfolio, Risk and Model Management

BITA Wealth provides rapid assessment of a current portfolio and ‘what-if’ changes against risk, policy, model and IPS/mandate, before exporting trades.

Client Suitability Profiling and Proposals

BITA Wealth uses its proven multi-facet questionnaire, scoring and profiling process to match a client’s profile to the investment proposition of a firm and set the mandate.

ESG Practical Management

BITA Wealth brings practical ESG management to your desktop through four easy steps.